IOS

Android

MTB securities

MTB Capital

Agent Banking refers to providing financial services to the underserved population through engaged agents who conduct banking transactions on behalf of the bank. These agents or retailers who are usually the owners of outlets, are increasingly becoming an important distribution channel in reaching to the unbanked segment of the society in addition to the existing customer with a wide array of financial services specially to geographically dispersed locations.

Agent Banking:

Over the years, Agent Banking has proved to be very effective for developing countries which lack access to formal financial services. Agent Banking has been a revolutionary inclusion in the financial systems of Brazil, Columbia, Peru, Malaysia and Kenya. In all the three countries, Agent Banking has been most successful in easing payments made by different households particularly utility bills, taxes etc. In remote areas, as data suggest, such payments account for more than 70% of the total transactions.

In Bangladesh, with more than 650 licensed Microfinance Institutions (MFIs) operating with a client base of around 40 million in different regions, the outreach of microfinance institutions is vast. While these MFIs have done a great job by targeting the poverty-stricken segment and providing small-scale financial services to these marginalized people, they have limitations as far as the regulatory framework is concerned.

Understandably, in some cases, it may not be financially feasible for a bank to open a full-fledged branch. In such cases, the agent outlets can act as mirror bank branches. The agents will provide banking services to the people on behalf of a bank and the nearest branch of the bank will provide necessary logistic support.

As a result, the need for Agent Banking became more justified. If the vibrant banking sector is properly guided by the Central Bank guidelines, Agent Banking can ensure the access of the marginalized people to several financial services in remote areas. It can work wonders in ensuring financial inclusion and materializing the dream of a poverty-free Bangladesh.

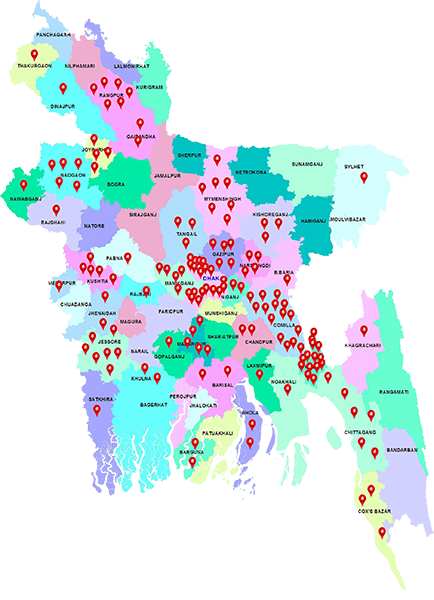

Total MTB Agent Banking Center

District Covered

Rural Area Covered

Urban Area Covered